IfiniteWealth Team

Is Value Add Real Estate a Good Investment?

Value add real estate investing is a strategy where a real estate investor purchases an existing asset with in-place cash flow that is not operating at its full potential. The strategy aims for improved cash flows and value through physical and operational improvements.

On a mission to unlock the potential of real estate investing. We are rebuilding the real estate investment experience, making buying, earning income, and selling income-producing real estate instant, low cost, and enjoyable.

IfiniteWealth

As a real estate investor, one of your goals may be to earn current cash flow from your properties, as well as compound your capital from appreciation in the underlying asset.

One of the best ways professional investors pursue this is through a value-add real estate strategy.

In this article:

What is value-add real estate?

-

- <

As most commercial properties are valued based on their income-generating potential, by increasing the property’s net operating income (NOI), the owner increases the property’s valuation.

Like most commercial real estate investments, value add real estate investors will often use a medium to a high amount of leverage to acquire property to take advantage of the naturally strong cash flow profile of commercial real estate.

Once the owner has increased NOI, they can generally either:

- Refinance the asset

- Pull out equity from the higher-valued project

- Keep it for a long-term hold

- Exit the deal entirely via a disposition (most common)

In all cases, the owners and investors capture the equity created through the improvements in value.

How do value-add properties compare to other real estate investment strategies

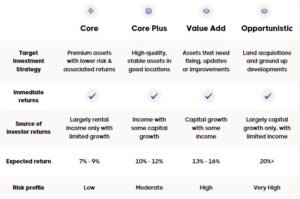

Value-add investing sits higher on the risk curve than other strategies, although it is not as risky as new development or opportunistic developments as there is an existing asset and cash flow in place.

Here is a high-level overview of the four real estate strategies:

- Core Properties are typically the lowest risk of the strategies listed here and are primarily targeted for existing income.

- Core-Plus Properties bear slightly more risk than Core investments and may require light property improvements, tenant repositioning, and stabilizing the existing asset’s cash flow.

- Value Add Real Estate requires more substantial property improvements, including the redevelopment and repositioning of an asset. These improvements can range from light value-add improvements to heavy value-add investments.

- Opportunistic Real Estate generally refers to ground-up construction and development projects and/or property conversion from one use to another (e.g., office to multifamily).

Here is a look at how these real estate investment strategies compare:

In recent years, the implementation of value-add strategies in the private real estate sector has been on the rise primarily due to the compelling benefits these strategies offer, including potential for higher returns and improved asset value.

As property prices continue to rise as more capital comes into the market to compete for returns, traditional buy-and-hold strategies may not deliver the desired returns, leading investors to seek alternative methods to enhance profitability.

Examples of value-add real estate investments

There is no shortage of ways for operators to add value to a real estate asset.

The methods will be mostly governed by its relative positioning in the local market and how it competes for renters with other comparable housing units in the area. There are also variables on the asset, including

- What is driving the property’s NOI

- Where there is room for improvement

- Whether the operator wants to take on a light, medium, or heavy value-add business plan.

Here are several examples of operational enhancements for value add projects:

- Interior Upgrades

- Exterior Upgrades

- Creating more leasable space

- Replacing the property management company

- Improving the rent roll quality of the bilding

- Repositioning or rebranding the property

Interior upgrades

It’s not uncommon for upgraded units to immediately attract higher rents, which can be done gradually to avoid high vacancy levels.

Interior upgrades can range from modest (new paint, carpet) to more substantial (unit reconfiguration). Updating old wiring and plumbing is also critical during any value-add renovation.

Exterior upgrades

Painting, landscaping, replacing the roof and windows, and adding selective outdoor amenities (e.g., a fire pit area, outdoor kitchen, replacing a pool deck, or adding a dog run) can add value to any property.

While exterior upgrades improve quality of life, this can be a less clear reason for landlords to attract higher rents as everyone in the community benefits equally and cannot be tied to individual apartments.

Creating more leasable space

Owners should be creative as they look for ways to create more leasable space. This could include, for example, finishing a basement that can be repurposed for resident use.

An owner might also look at converting a garage into living space. In larger apartment communities, adding Amazon delivery lockers and/or adding storage cages has become more popular as tenants are willing to pay a premium for these amenities.

The rise of Accessory Dwelling Units (ADUs) in Los Angeles provides a great example of creating additional leasable space.

Many multifamily operators have been acquiring smaller apartment complexes and adding ADUs to significantly enhance the value of the investment. For example, a simple ADU strategy could be:

- Find an apartment complex with ample yard or parking space that isn’t fully utilized

- Add two ADUs to the property, effectively increasing the number of rentable units from 10 to 12

- ADUs create an additional stream of rental income and increase the property’s overall Net Operating Income (NOI).

This approach is particularly relevant in markets like Los Angeles, where housing demand is high and recent changes to state law have made it easier to construct ADUs. By adding these units, the investor is not just creating more leasable space, but also significantly increasing the value of their initial investment.

Replacing the property management company

Many owners have long-time property managers in place who may not be performing their duties as effectively as they could in supporting a well-maintained and sought-after rental community.

This may be evident in situations with low lease collections, high vacancy, and slow response times for repair and maintenance (R&M) requests. Re-bidding the contract can result in better service—oftentimes a lower price, reducing operating expenses.

As an example, imagine you invest in a 20-unit apartment complex generating $500,000 in gross potential revenue, managed by a firm charging $30,000 annually, with slow lease collections and a 10% vacancy rate.

Deciding to re-bid the contract, you switch to a more efficient firm that charges $28,000 annually. With their improved management, the vacancy rate drops to 5%, increasing the annual rental income by $25,000.

Besides saving $2,000 in management fees, the change brings in $25,000 increased income and better tenant satisfaction, highlighting the benefits of periodically re-bidding property management contracts.

Improving the rent roll quality of the building

A rent roll is a management tool used by commercial real estate operators that details the lease information and helps landlords track the start and end dates of contracts and rental income.

With the new management team in place, tenants from underperforming units can be evicted, and the management company begins to enforce stricter policies to ensure on-time payments.

As the quality of the rent roll improves – NOI can be increased or even become higher quality through the value add improvements of improving the rental and leasing management.

Repositioning the property

While an owner works to execute physical and operational improvements, they should simultaneously embark on a repositioning the property for a different use, or rebranding of the property away from its former tenant mix.

Building 77 in Brooklyn Navy Yard is a prime example of a repositioning value-add strategy. This former World War II storage facility was redeveloped into a vibrant, multi-tenant industrial hub, increasing its Net Operating Income significantly.

This transformation, which included major renovations and a rebranding, turned a once outdated warehouse into a bustling business center, attracting tenants from various sectors. The process, however, took several years, highlighting the importance of considering timelines in value-add investments.

Core-Plus Real Estate

Core real estate is usually a fully stabilized, Class A building in a strong market with a growing economy. Core investments tend to have predictable income and are considered low risk. Private equity firms often own core properties.

These include older properties located in primary markets, as well as Class A/B properties located in secondary and tertiary markets. Core-Plus real estate is often of a slightly older vintage than Core properties and may require slight physical and operational improvements needed to realize the property’s full potential. Core-Plus properties are usually low to moderate-risk investments.

Value Add Real Estate

Value add investments refer to properties that need substantial renovation or operational improvements to stabilize at or above local market rents.

A “light” value-add strategy might involve refreshing each apartment unit with new paint, carpet and fixtures and replacing the management company with one that’s more professional and aggressive about rent collections.

A “heavy” value-add strategy could include gutting a property to the studs, reconfiguring the units, and upgrading the building systems and façade. However, even heavy value-add strategies assume the property types remain as-is, and no use change is required.